Enrollment

Whether you’re enrolling in a Blue Cross Medicare Advantage plan for the first time or switching your Blue Cross Medicare Advantage plan, there are three ways you can enroll.

Plan Star Ratings

Every year, the Centers for Medicare & Medicaid Services (CMS) evaluates Medicare plans based on a 5-star rating system, with 5 stars being the highest score a plan can receive. More stars indicate better performance and quality.

Learn more about star ratings.

| Blue Cross Medicare Advantage Plans | Star Rating |

|---|---|

| Blue Cross Medicare Advantage Classic (PPO)SM Blue Cross Medicare Advantage Choice Plus (PPO)SM Blue Cross Medicare Advantage Choice Premier (PPO)SM Blue Cross Medicare Advantage Elite (PPO)SM Blue Cross Medicare Advantage Flex (PPO)SM Blue Cross Medicare Advantage Health Choice (PPO)SM Blue Cross Medicare Advantage Protect (PPO)SM Blue Cross Medicare Advantage Saver Plus (PPO)SM Blue Cross Medicare Advantage Dental Premier (PPO)SM |

3 2024 Plan Star Rating |

| Blue Cross Medicare Advantage Basic (HMO)SM Blue Cross Medicare Advantage Basic Plus (HMO-POS)SM Blue Cross Medicare Advantage Value (HMO-POS)SM Blue Cross Medicare Advantage Premier Plus (HMO-POS)SM |

2.5 2024 Plan Star Rating |

Enrollment Periods

There are four enrollment periods for Blue Cross Medicare Advantage plans. Review them to determine which one is right for you.

Annual Enrollment Period (AEP)

Anyone can join, switch or drop a Medicare Advantage plan or a Medicare Advantage Prescription Drug (MAPD) plan between October 15 and December 7. If you apply for a plan during this time, coverage begins on January 1.

Open Enrollment Period (OEP)

The Medicare Advantage Open Enrollment Period (MA OEP) is January 1 through March 31 each year. During this time, Medicare Advantage enrollees can pick a different Medicare Advantage plan or switch to Original Medicare with or without a stand-alone Part D plan. You may only make one election, or plan change, during the MA OEP. You are also eligible to use the MA OEP to make a plan change if you are a new Medicare beneficiary who enrolled in a Medicare Advantage plan during your Initial Coverage Election Period (ICEP), which is the first three months you were eligible to enroll. In this case, the OEP occurs from the third month of eligibility to Part A and Part B through the last day of the third month of eligibility.

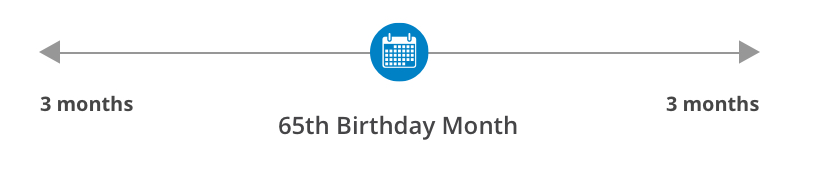

Initial Enrollment Period (IEP)

When you first become eligible for Medicare, you can join during this seven-month period that starts three months before the month you turn 65, includes the month you turn 65, and ends three months after the month you turn 65.

Special Enrollment Period (SEP)

In most cases, you must stay enrolled in the plan for the calendar year when your coverage began. But when certain events happen in your life, you may be able to join, switch or drop a Medicare Advantage plan and a Medicare prescription drug plan and return to Original Medicare during a Special Enrollment Period. Below is a list of some, but not all, of the events that may qualify you for an SEP:

- You move outside of the plan’s approved service area

- You enter or leave a qualified institution, such as a nursing home

- You quality for low-income subsidy assistance (Extra Help)

- You enroll in Medicaid

- You involuntarily lose creditable prescription drug coverage

- You leave or lose your employer's health plan

Contact us if any of these situations apply to you.

For more information, refer to the Medicare & You handbook.

Useful Tools

Last Updated: Jan. 04, 2024

Last Updated: 03222024

Y0096_WEBILMM24_M